Opening Bell 🔔: Saving the best for last, Austin saw the nation’s largest building sale in December as Cousins bought Sail Tower from Trammell Crow for a whopping $521.8 Million ($649/SF).

The Fed’s decision to cut interest rates in the later half of the year nudged some players off the sidelines, but there’s still an uncertainty as to where office goes from here. Let’s dive into it.

Market Snapshot 📸: Austin saw an uptick in sales volume (easy when you have a half a billion trade happen) with over $755.3 million in trades between November and December. At an average of $154/SF across all submarkets, the market is continuing to reset itself and many believe this the bottom of this cycle.

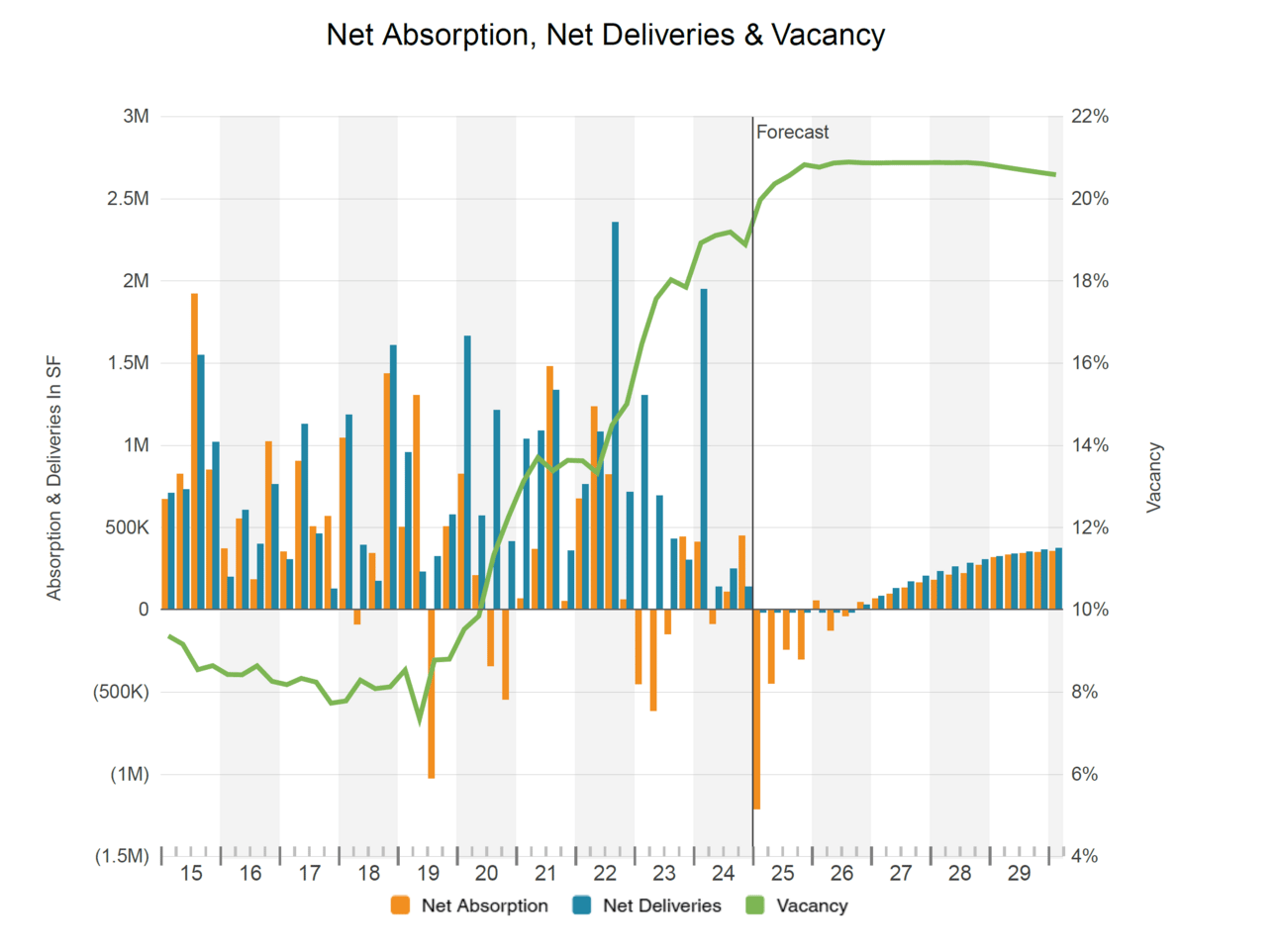

Dive Deeper 🤿: While buildings are starting to trade hands, new and old owners face the same question of “how do we fill this space?” Vacancy in Austin ended the year at 18.9%, a 0.3% decrease from Q3, but still significantly higher than pre-pandemic days. Net absorption was positive for a second consecutive quarter at 448,864 SF, a good indication that as the construction pipeline clears out, vacancy rates should start to come back down to earth with them.

Landlords & Investors alike are running out of time

Zooming out at scale, there was a 1% increase in commercial outstanding debt in Q3 of 2024 according to ConnectCRE.

Reminiscent of the old adage, “the only way to lose the game is to stop playing,” Landlords and investors might have to stop playing here soon. Some are feeling the squeeze of rising debt coupled with vacancy rates, those that are able to weather the storm longer stand the most to gain while others may be forced to cut their losses now.

Pro Insight 🧑🏫 : Good things take time. Spaces are taking longer to both lease and sell, a continued trend since the pandemic as decision makers find themselves cautious to pull the trigger on deals. The Fed’s decisions around what to do with interest rates as we get into 2025 will have a significant impact as more debt becomes due.

New owners might be getting properties at a significant discount, but many will have to pour sizeable amounts of improvements into the properties to make them attractive landing spots for new leasing activity.

Final Buzzer 🚨: While Austin continues to be a more optimistic market compared to nationally, wait and see isn’t an option for many players at this point. Expect to see more trade volume and lower rates as this tenant friendly market extends into the new year.

Ownership groups that are willing to adapt to this new landscape will be the ones coming out ahead in the long run, even if that means putting a bit more into their properties.