Opening Bell 🔔: Last week marked the end of Q1 of 2025, here’s the quick hits of what you need to know.

Average Rents fell by $.06/SF to $30.19 nnn (across class A & B office assets), a $.67/SF from Q1 2024.

Direct Vacancy Rate rose by 1% to 18.7%, still down 1% from this time last year.

Deliveries dropped and so did the amount under construction as the development pipeline clears out around the city.

Over half a million SF of sublease space was removed this quarter, bringing us under 5 MSF.

There was over 1 MSF of leasing transactions in the quarter, but we had a negative absorption of -306,765 SF.

Market Snapshot 📸: We tracked down over 100 leases accounting for 1,026,732 SF of activity in the quarter. Here’s where majority of leasing activity is happening.

Austin Leasing By Submarket

Downtown and Austin’s “Second Downtown” North/Domain proved to be the hotspots to start the year. 6 out of the 8 largest leases were done in these submarkets.

Dive Deeper 🤿:

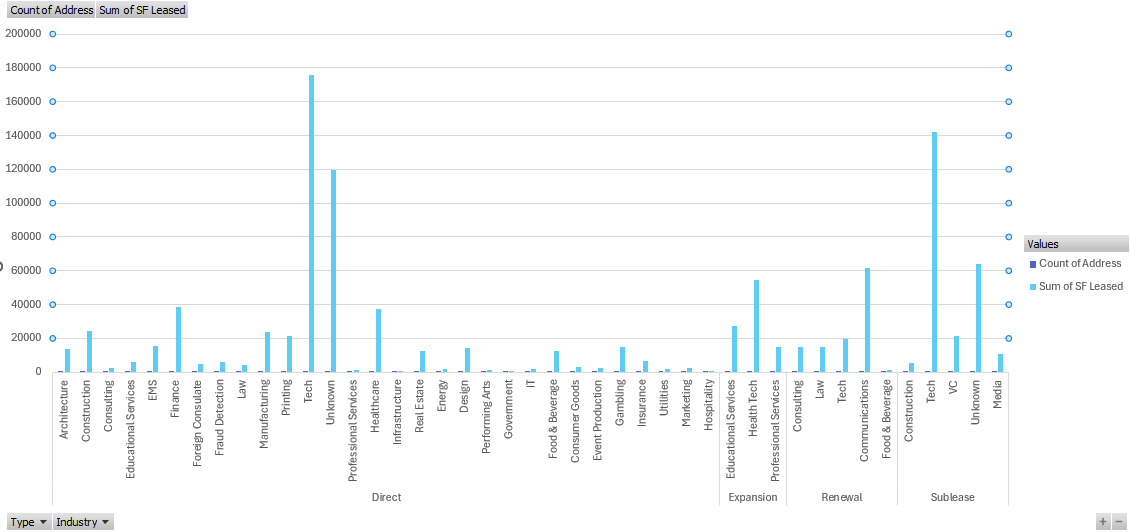

Austin Leasing by Industry and Lease Type

Peeling back the layers, while the Tech industry took the most sizeable leases, the Financial sector was even in terms of deals executed. Moves like LegalZoom’s selling of their building in Cedar Park ($180/SF) and moving into a sublease in the Domain show the continued restructuring of Real Estate needs by large companies in the tech space.

An industry to keep an eye on is the Healthcare sector as they accounted for 10 direct leases and the largest expansion this quarter came from health tech provider, Natera as they expanded 54,452 SF in Parmer 7.3. This is expected to continue to rise MD Anderson and UT Austin announced their latest joint venture last week.

Pro Insight 🧑🏫 : With large new projects like 415 Colorado and Alto being delivered this quarter, it was anticipated for vacancy to rise. Rents are dropping in Class B properties ($.89/SF in CBD alone) to keep pace with the new inventory. Ultimately, tenants will continue to drive where this market goes. The good news is Austin’s Business-Cycle Index continues to grow and unemployment is still nearly a full 1% lower than the national average. The bad news is there’s a lot of space available with more anticipated in the coming months. Expect to see a continued flight for quality and a wider gap in rental rates between class A and B buildings as lower quality buildings find ways to compete with the new supply.

Final Buzzer 🚨: Despite global economic uncertainty in this present moment, Austin’s economic indicators remain strong and while tech may not be leasing at pre-pandemic rates, they’re still leading the charge in leasing activity. Both good signs for the overall market.

Looking ahead, we expect Q2 to mirror that of Q1 with soft leasing, elevated vacancy, and tenant-favored conditions.

We’ll see you next week,

Cory